A Picture Of History

There is no serious effort in Washington to deal with our so-called debt crisis. I would like to think this is because people realize we don’t have one, but a more realistic interpretation on non-events is that the Republicans are stuck in a rut of obstruction. They have no policy other than to contradict whatever Obama says. Even if this means contradicting what they themselves said in the past. At the moment this obstruction produces gridlock on any constructive efforts to get the economy moving at a more rapid pace. It also means avoiding negotiating on the budget, even though both the Senate and the House now have working budget proposals. The problem seems to be that were the Republicans to engage in negotiations they wouldn’t be able to engineer a crisis atmosphere within which they could extort excessively. They want, apparently, to wait until we nudge back up against the debt ceiling at which point they can reload their hostage taking weaponry and cause the nation greater mayhem.

This is, of course, juvenile and irresponsible. But it remains the current GOP modus operandi.

They are stuck in this supremely negative position because the economy has recovered enough to draw the sting out of the deficit. As I have mentioned before, the government’s budget outlook has improved. If by improved you mean it is edging towards a better balance and away from the endless free fall of the deep crisis years. They are also stuck because their own budget proposals have been demonstrated to be hollow, lacking any principle, and largely made up. In other words the ‘crisis’ is receding and they have nothing much to say.

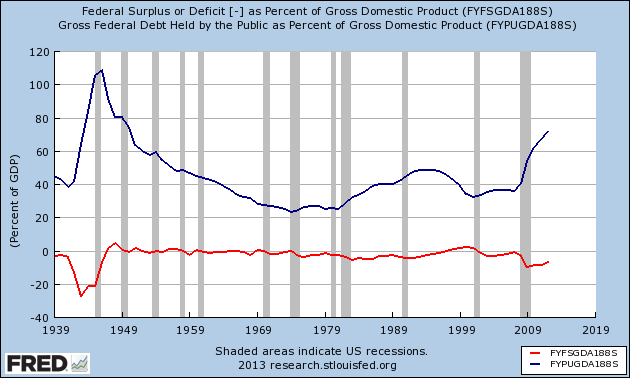

Nonetheless I suspect this phony silence will be broken by bouts of bickering. So in the spirit of public education I offer you the chart below. It shows the amount of debt held by the public – i.e. it ignores debt where one part of the government owes another part. That’s the blue line. And it shows the annual deficits. That’s the red line. Both are shown as a ratio of GDP.

You will note a few things:

- The debt to GDP ratio was much higher at the end of World War II than it is now

- The healthy growth of the 1950’s through 1960’s, coupled with very small budget imbalances, allowed the debt to GDP ratio to fall consistently and significantly

- The debt to GDP ratio turned back up when Reagan moved the budget into larger deficits

- That the ratio then improved under Clinton

- It worsened again under Bush II

- And it fell off a cliff at the end of Bush II and the beginning of Obama due to the mega-recession

- Finally, you can see that the budget is improving, which implies that the debt to GDP ratio will not worsen much more. Indeed it may improve.

The lessons?

- The debt to GDP ratio has been much worse than it is now, and yet the world did not come to an end

- The Republicans have been more fiscally reckless than the Democrats – at least since WWII

- Growth [and inflation], not austerity, is the most successful healer of a debt problem

Anyway, here’s the chart: