A New Year — Happy or Not

I am not going to become involved in endless analysis of Trump’s presidency. I think we ought let it speak for itself.

Nor am I going to waste space critiquing the huge contribution that academic economics has made to Trump’s rise to power. I think the anti-democratic nature of mainstream economics is both palpable and speaks for itself too. Economics is largely a libertarian discipline and sneers at anything remotely involving “we the people” unless it can re-package us as some sort of mystical marketplace. In which case we all are perfect. It’s only when we vote that we, apparently, become venal, self-serving, irrational, and riddled with error.

Nor am I going to re-litigate the Clinton campaign, it was so lamentable in its total misunderstanding of the state of the nation that it deserves legendary status as an all time bust. Then again we ought to have been warned: Clinton was rejected in 2008 for very similar reasons. Quite why the Democratic Party powers-that-be allowed themselves to be fooled by her combination of incompetence and neoliberal nonsense is beyond me.

With that out of the way: we enter a new year of remarkable uncertainty. Trump is an extraordinarily weak man, he is prone to gaffes, he has no clue about economics, his foreign policy is already disrupting alliances and making the world less safe, and he will undoubtedly be at odds with the Republicans in Congress before long. My guess is that they realize how easily he can be maneuvered by the simplest of flattery and they are thus salivating at the chance to ram through their anti-social attack on workers, the safety net, and all things vaguely Obama as soon as things start up again later this month.

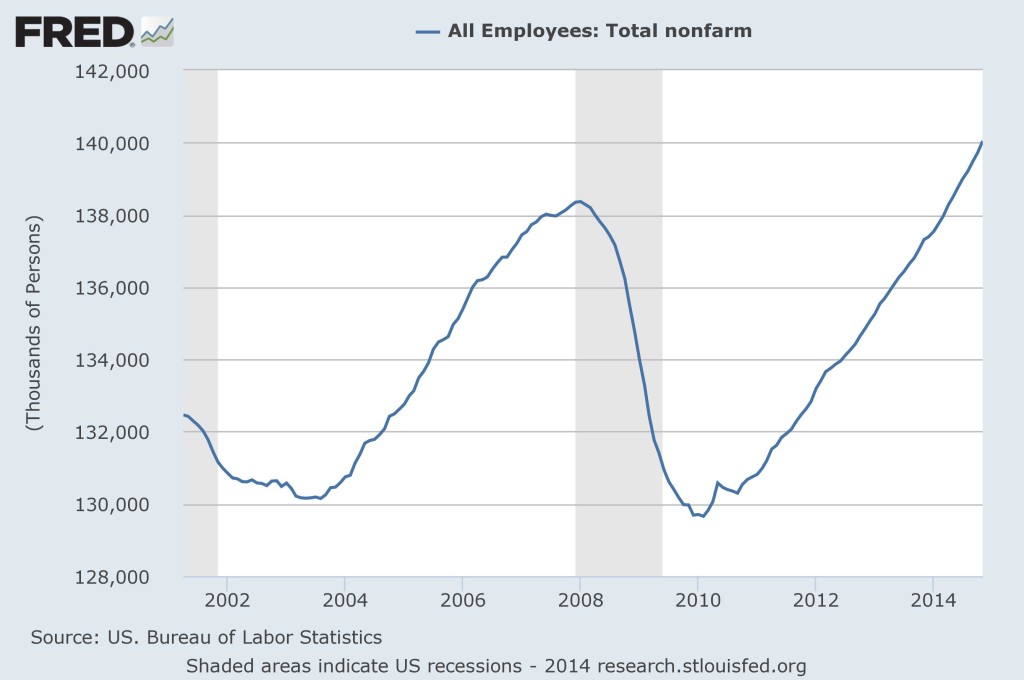

I would like to be able to say that Obama left the economy in reasonable shape, but the scar of inequality prevents me from being able to. The enormous gulf that has opened up in society, with one part able to trumpet opportunity, wealth, and optimism, and the much larger part facing decline, stagnation, pessimism, and decreasing healthiness is the legacy of the entire Reagan/Clinton/Bush/Obama era. It is a blot on our own sense of achievement. It is a blight that the next few decades will have to both endure and attempt to eliminate.

In many ways Trump is the perfect coda to that failed era.

No one in high policy position has had the courage to confront the great sea-changes in our prosperity being wrought by the scourge of globalization, automation, and oligarchic control of power. They all lie about the possibility of manufacturing returning to these shores. Perhaps it will, but only as an automated activity.

Nor do they address the emerging de-construction of traditional business being brought about by the relentless pursuit of shareholder value. Managerial capitalism is steadily cannibalizing itself as executives seek to maintain unattainable growth goals and to reward themselves for ever shorter-lived and less sustainable profit margins. Unlike a few others I don’t see this as a death knell for capitalism as a general phenomenon. I see it more as yet another mutation along the way. The oligarchs and executives will cling on for a while in order to squeeze unearned rents from the rest of us, but their own greed will eventually tip the economy into a new configuration that they no longer control. The dawn of the “gig-economy” is upon us. Whilst it looks bleak at the moment — far too many people are sucked into it against their will — after a decade or so that will change and the power relationship will shift against the bureaucrats running our oligopolies.

What we need is a thorough revision of the institutional landscape that supports business activity in order to counter-balance the shift in risk that everyday workers have had to assume as business leaders have steadily attacked the old order of employment. That attack was instituted to bolster profit in the face of ever decreasing inventiveness and the growth opportunity. Business leaders compensated for their lack of imagination and talent by eroding the post-war contract with workers and replacing it with a patched-together alternative in which workers bore the brunt of life’s risks. That burden decreased people’s ability to spend, setting in motion the slow stagnation that now has us in its grip.

So retirement, training, health care, and other sorts of benefits that helped workers in the old order were steadily reduced or stripped away to save business money.

But as workers were forced to accept theses risks they were not compensated with higher rewards. No. Those rewards were syphoned off by capital owners who sought ever increasing returns even in an economy quite obviously incapable of supplying them in the longer term.

The result was a top-heavy economy, awash with excess capital which found its way into various bubbles, with stagnating wages and rising inequality, with lost opportunity, and with slowly foreclosing prospects for future generations. America has produced a class system in an economy that once was proudly the most egalitarian in the industrialized world. Enter Trump.

As, however, a new generation rises up within this new landscape, it has the chance to re-make the egalitarian dream. It can, and I think it will, break the back of the oligarchs. Why? Because the oligarchs represent the past of business. They are cannot comprehend the future nature of the loose employment contracts that they seek to exploit because they see them in the context of the industrial era institutional arrangements they benefit from. But as the institutions of the economy change, and as those new institutions restore the balance of risk and reward in the economy, the oligarchs themselves become less and less relevant.

The new year is simply a step into this tumultuous future. Changes are afoot. Trump is a reflection of what has gone. He is nothing to do with the future beyond, of course, his ability to muck things up over the next four years.

And here’s the exciting part: as we move into the post-industrial economy more deeply the ability of capital to dictate its course diminishes. The digital economy is based more on intangible goods and services than on massed-produced stuff. Intangible things use less capital to produce. Indeed we can self-produce a part of it ourselves. So the capital accumulation of the past hundred years — those few generations in which the might of industry dominated our economic lives — will become an historic aberration. There will be an excess of capital. Not simply because of the incompetence of our businesses in generating innovations in which to invest, but also because future innovations are less capital intensive.

That leaves a great pool of capital sitting around for us to tax and re-distribute.

Now if only we had politicians who realized that.

Happy New Year.