Signs of Life? Part 2

Yesterday’s reports of economic strength have been followed by a couple of similar reports today. We are spoiled by good news. Well sort of.

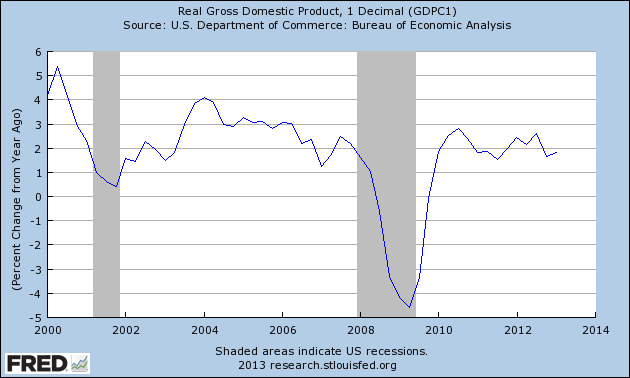

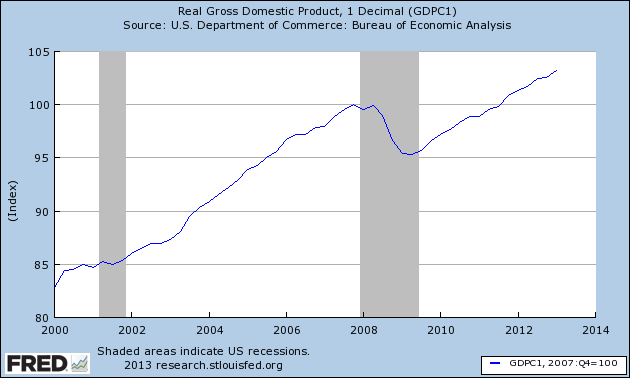

The headline grabber will be the news that GDP grew 3.6% in the third quarter. If you recall, the first estimate had growth at a much lower 2.8%. This level of growth is the highest we have seen for a while and would, on the surface, suggest things have taken a turn for the better.

But, of course, that’s just on the surface. Before we get to the enigma inside the news let’s run down the basic facts:

- Personal Consumption rose by 1.4%, which added +0.96% to that 3.6% total

- Private Investment grew by 16.7%, which added +2.49% to the total

- Exports grew 3.7%, while imports only grew 2.7%, which means that net trade added +0.07% to the total

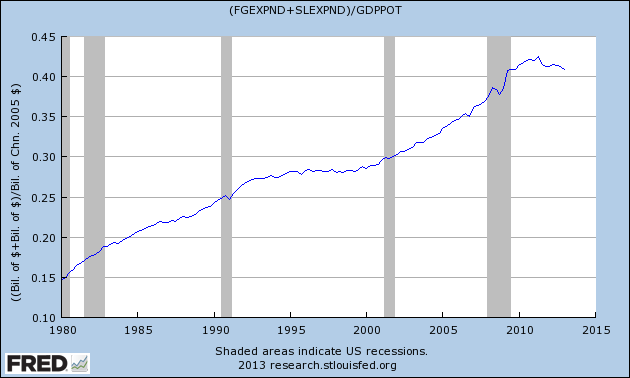

- Federal government spending declined 1.4%, but State government spending rose 1.7%, so overall government spending added +0.09% to the total

So what’s the enigma?

First, personal consumption, which accounts for around two-thrids of the entire economy, had its slowest rate of growth for a while. In fact you have to go all the way back to 2009 to find weaker growth. This does not auger well for the economy. Clearly households are still holding back. Or, which is more likely, they are being constrained by weak employment and wage growth. All those arguments about inequality and our incredibly skewed distribution of wealth are relevant to this part of the economy: there may be a lot of cash sloshing around the economy, but if it doesn’t end up in the average household where it is more likely to get spent, then the economy doesn’t benefit.

Second, and this may well follow from the prior point, the big jump in private investment was ruled by a second quarter of huge inventory accumulation. Indeed almost half of all growth in the third quarter can be accounted for by inventory build up. This, to put it bluntly, is not a good thing. There are always two interpretations of inventory accumulation. The positive spin is that businesses are sensing an imminent burst to consumption and so stock shelves in anticipation of strong sales. The negative spin is that businesses stocked shelves but the sales didn’t materialize and so production will have to be cut in order to allow stocks to run off. I think there is more of that second explanation than the first in last quarter’s numbers. Demand looks weak. Inventories are too high. Production will have to be adjusted downwards. This implies a weaker economy in the next quarter or two.

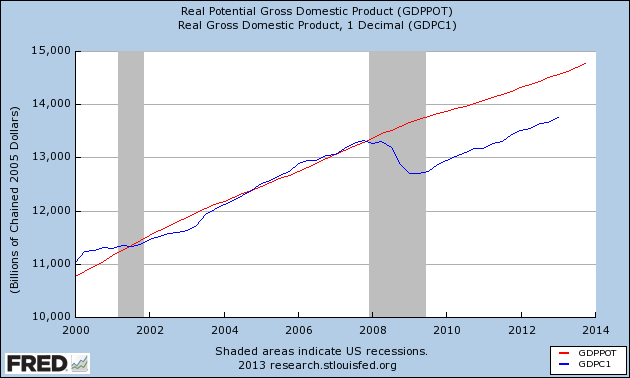

We ought not to leave GDP without commenting on the continued shrinkage of Federal spending. In ten of the last twelve quarters Federal spending has declined. This puts a dampener on overall growth, which is the exact opposite of what we need. There is a time and place for budget cuts, the last few years was not such a time. We have, due to wrongheaded austerity policies, prolonged and worsened the economy’s weakness.

There’s no news in that. But we ought to resist further austerity moves as determinedly as we can.

The other report released today was the weekly summary of new claims for unemployment assistance. This was also unexpectedly good. Claims fell by 23,000 to 298,000. This is only the second time claims have been below the 300,000 mark since the recession, and, under normal circumstances would be very good news. There is a problem however. The report is seasonally adjusted, and such adjustments are always a little tricky during holidays like Thanksgiving, when newly unemployed people may delay making their first application for help. So, rather than get too excited, we all need to wait a week or two to see if future numbers reinforce or contradict today’s apparently upbeat message. Besides, as I have mentioned many times before, we all ought to focus on the four week moving average of claims because it is a more reliable statistic. That number also dropped nicely, by 10,750, to 322,250. So clearly there is positive momentum in the labor market. How much remains to be seen.

So there you have it, two good but flawed pieces of news.

The economy is still growing, employment is still improving, but neither is as strong as today’s reports suggest.

Which means we are still stuck in relative stagnation and still need help rather than hindrance from Congress. Good luck with that.