The Deficit’s Too Small!

The entire conversation in and amongst our elite, whether be in Washington in big business or in the media, seems to be about the Federal deficit and the evils associated with it.

Here’s my current thinking:

The deficit is too small.

And it’s shrinking too quickly. The recovery, anemic though it is, is reducing the deficit. Tax revenues are rising as incomes and employment slowly recover. And spending is decreasing as emergency aid and benefits are less necessary. Our short to medium term deficit was, it turns out, largely cyclical not structural.

Now I realize that this is not the message you normally hear, so bear with me. My point is simply that government spending in the US is being reduced so rapidly that the private sector’s anemic expansion isn’t able to keep up sufficiently. This means that the economy is not growing as quickly as we need it to and, thus, this long and tortuous period of very slow recovery is being lengthened unnecessarily. We are shooting ourselves, very effectively and with great accuracy, in the foot.

We have not yet, fortunately, fallen too deeply into the trap that the Europeans have set for themselves and gone headlong into austerity driven economic suicide. The Germans appear to have decided to destroy the Eurozone by enforcing austerity despite the growing political backlash. They are trying to turn the entire continent into a mirror image of itself, which requires everyone to pretend that it was fiscal profligacy and not a banking system failure and private sector debt that caused the crisis. This misdiagnosis naturally leads to the wrong prescription. Hence the misguided focus on government budgets and not on encouraging growth.

We went through the mother of all recessions, indeed our banking system and private debt misbehavior was the progenitor of the entire mess, but we, at least, managed to get a little and short-lived stimulus. So we avoided the Euro trap. So far.

But the conversation remains stuck in a monotonous cycle of debate about how much to cut, what limits to set, and how much pain will be necessary for us to make the great magical leap forward.

The answer to these questions are: none, none, and none respectively. We keep treating our longer term issues – largely the cost of our terrible health care system – as if they are here and now.

Our problem is that the US elite cannot break out of its unneeded focus on austerity because to do so would be an admission of political and intellectual failure. There is too much committed to austerity for the correct policies to be discussed let alone enacted. So we live in a surreal world in which the entire discussion is about something totally irrelevant to our recovery.

We need more spending, not less.

We need to continue the deficit and increase it somewhat, not shrink it.

This is because the normal levers of policy – manipulating interest rates and printing money – cannot and will not work in our present situation. This leaves us with a looser fiscal policy as our one route out of malaise. But it is the one policy we are not talking about.

There is nothing new in any of the above, but I thought I would repeat it for the umpteenth time in the vague and forlorn hope it would resonate somewhere.

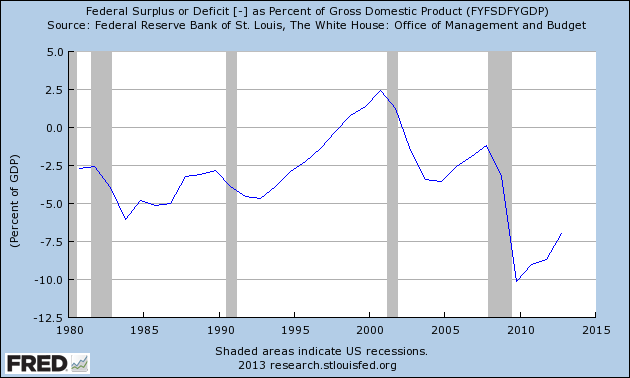

Anyway, since the austerity debate seems to be our fixation, let me point out that we have been squeezing the budget quite effectively – and wrongly – since 2010. That is if you look at the deficit as a ratio with respect to the total economy.

As you can see from this chart the cyclical reduction in spending has produced a rapidly reducing deficit. That upward slope is the sharpest tilt towards balance in the last forty years and is one of the primary reasons we are not seeing stronger growth. We have been overly austere. We are saving too much.

Why is this an important point?

Because none of the benefits of austerity have shown up. Not one. There has been no surge in confidence inspired supply side activity. And none of the downsides of easy money have shown up either: the much hyped and anticipated burst of inflation remains imagined but not real. In fact not one of the predictions made by the experts that litter our elite has turned out to be correct. Remember the Simpson-Bowles report? That was every serious person’s Rosetta stone of sensibility. Messrs Simpson and Bowles harangued us all about the evils of debt and loose money. They told us that disaster was a scant two years away if we didn’t enact drastic structural cuts to our budget – as opposed to the more cyclical reduction we have actually seen. That was over two years ago. Disaster hasn’t struck. The deficit has begun to shrink. Runaway inflation hasn’t shown up. Simpson and Bowles were flat out wrong. Meanwhile, practically every one of the predictions made by people like me who focus on aggregate demand as being our problem has been correct: the economy remains weak, low interest rates are having little effect, and unemployment is still a problem.

Which is why I feel confident in suggesting our present problem is that the deficit is too small.

That sharp upward slop in the chart above is a bad, not a good, thing.

Not that I expect anyone to listen.