Home Prices Rocket

There is very little news in the economy at present, hence my comparative quiet. Today, however, I have to make note of the Case-Shiller home price index results for April: prices rose at the fastest rate ever. Of course ‘ever’ in this case is only back as far as 2000 when the index was first compiled, but April’s record jump of 2.5% in the 20 city index is still notable. For the full year ending in April the increase was 12.1%, the fastest since 2006.

Nineteen of the twenty cities whose prices comprise the index saw increases over the past twelve months, with San Francisco leading the way with a 23.9% increase and New York City bringing up the rear with a modest 3.2% rise.

Low interest rates, a steep decline in foreclosed and distressed properties, and tight supply are all contributing to the sudden resurgence of home prices. We are still about 25% below the bubble peaks so this surge ought not concern us too much just yet, and as price keep rising there will be an increase in supply as homes currently underwater – they were bought closer to the peak of the bubble – become more easily sold. This effect will dampen price increases somewhat as buyers find they have more choices and consequently less pressure.

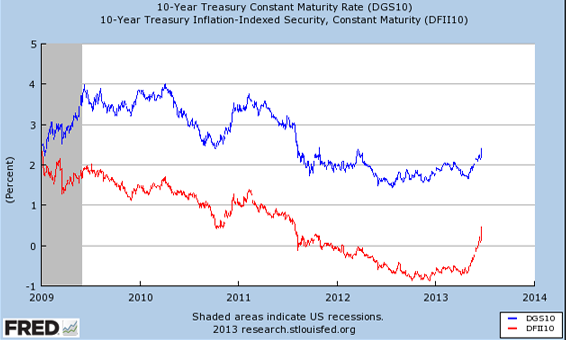

Then there’s this:

Interest rates have risen as the credit markets try to figure out exactly what the Federal Reserve Board is doing. A stream of mixed messages and confusing statements has shaken the market up a bit. And as you can see from the chart rates have been bid up because investors now anticipate an end to the Fed’s efforts to prop up the economy.

The fun line to watch on the chart is the red one which tracks the inflation proofed interest rate. If you look closely you will see that for a much of the past eighteen months the ten year rate has been below zero. This ought to end the debate about the inflationary dangers of the Fed’s actions, but that would require some thought and an admission of error on that part of the more hawkish amongst us. That won’t happen however.

Since long term rates are the ones that have the greatest impact on the public, the market’s jitters could dampen activity later this year if the spike up at the end of those lines on the chart don’t start to level off. Actually now I think it through a bit more: perhaps the Fed is playing a game here. A little spike in rates – one that is muted later on – could be just enough to put a brake on home price inflation and nip the emergence of a new bubble in the bud. Let’s hope the game works without causing too much collateral damage. Congress doesn’t need any help in causing damage.

But that’s another story …