Where Our Spending [Really] Goes

We are into the silly season of budget debates in Washington. Dueling budgets are flying back and forth. Different ideologies are ensuring that the gulf between the right wing preferred budget and all the rest is enormous. As in unbridgeable. The reason is that our contemporary Republican party wants to dismantle ‘big’ government and reduce spending radically.

Or does it?

Well that depends on what you call ‘spending’.

I know, it ought to be pretty obvious. In a very famous case back in England a judge twas asked to define income tax. It was, he said sagely, a tax on income. But, as in all things that involve lawyers, income, or in our case spending, isn’t as obvious as it could be. The problem stems mainly from when you start to run the clock on what constitute ‘expenditure’. Is it after you have collected all the taxes and are ready to write checks? Or is it before you collect those taxes? Does ‘expenditure’ include all the giveaways in the tax code?

Of course it does.

Think about it. When the government writes a check for a Medicare payment it records that as an expenditure. As it does when it buys an aircraft carrier. As it does when it buys paper clips for its bureaucrats. And so on. Those kinds of government spending are clear and unequivocal. It’s all that hidden spending that can be confusing. And it’s hidden on purpose. Politicians want to spend on lots of pet projects. They want to reward loyal voters. Sometimes it is easier to get that money spent through the backdoor because that way it is less easily computed and the economic impact harder, though never impossible, to estimate. In other words if you have made a lifetime of beating up layabout welfare queens it is a little difficult to syphon off government money to a special pet constituency overtly. It’s better to hide it.

So hide it they do.

In spades.

They do it by devising all sorts of tax credits and deductions. There is no difference between the government writing a check for something, and it giving you a break on your taxes for the same thing. Either way the net revenue of the government is reduced by the cost of the expenditure.

So, to take an egregious example, the US government likes to encourage home ownership. It is seen as a jolly good thing. It helps build communities. And so on. But instead of sending you a check to help you buy a house – that would look a lot like welfare for relatively well-off folks – the government subsidizes your mortgage by giving you a break on the interest cost. It amounts to the same thing.

Welfare is welfare. Spending is spending. And tax breaks are a way of spending the government’s money without drawing too much attention to what’s going on.

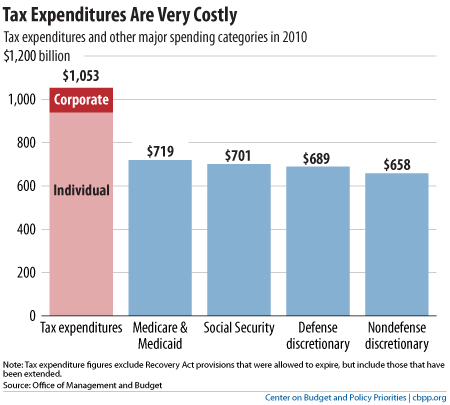

And these so-called ‘tax expenditures’ add up. They add up big time. Indeed they are the biggest single thing the US government spends its money on. Bigger than Social Security. Bigger than Medicare. Bigger, even, than defense.

Let me shamelessly borrow a chart from the CBPP:

Yes that big.

We spend a lot on ourselves through that backdoor.

The mortgage interest subsidy isn’t alone of course. There’s a ton of others. The biggest is the tax deduction given to businesses on the cost of health care plans they provide their employees.

Think about that for a moment and weep.

The government subsidizes – it pays for – a proportion of every single so-called ‘private’ health care plan provided by employers. And the Republicans think we have a ‘private’ health care system! No we don’t. The government chips in. It chips in a whole lot.

Then there’s the reduced tax paid on capital gains. A gain is income by another name, but it somehow sounds special if we call it a gain. It sounds kind of thrifty. Plus it makes it easier to subsidize by reducing the tax on income from ‘gains’, as opposed to, say, income from wages. So people who get their income from gains rather than wages get a government subsidy. It’s actually welfare for the rich, but that’s difficult to sell at election time, so instead of writing the Rockefeller’s a check at from Welfare office, we give them a tax break instead.

The list of popular tax expenditures is long: employer health care plans; pension plan contributions; mortgage interest rate relief; accelerated depreciation for business; deductions for state and local income taxes; charitable contributions; lower taxes on qualified dividends and capital gains; etc, etc.

And here’s the really important part of the story: the people who benefit the most are the wealthiest. The top 1% of income earners get about 13.5% of all the spending. The rest of the top 20% get another 11.5%. By comparison the bottom 20% – part of the so-called moochers that Mitt Romney referred to – get only about 6.5%. In other words our so-called ‘progressive’ income tax, where the rich are supposed to pay more than the poor, is substantially reversed and made regressive by these hidden welfare programs for the rich and upper middle class.

So who’s mooching most?

This is important. Very important. Because as we prepare to enter the battle to decide what to cut the focus is on the obvious. We are told that we cannot afford those entitlement programs, and that we need to curtail Social Security or Medicare. But we never are told we cannot afford to subsidize capital gains. Or mortgages. Or healthcare plans. Or dividends. Or charitable donations. Or any of those other backdoor expenditures.

Why not?

Because they benefit the rich? The people who donate at election time?

Guess.

We are not having an honest discussion.

What a shock.