What’s Missing?

A couple of days ago I complained about the misrepresentation of Federal spending under Obama. It hasn’t risen anywhere near as much as some folks say it has. Indeed it has been under control since that first burst during the heat of crisis.

That drew the ire of one or two of you who complained that the real issue is not the budget, but the economy and its chronic under performance.

I agree.

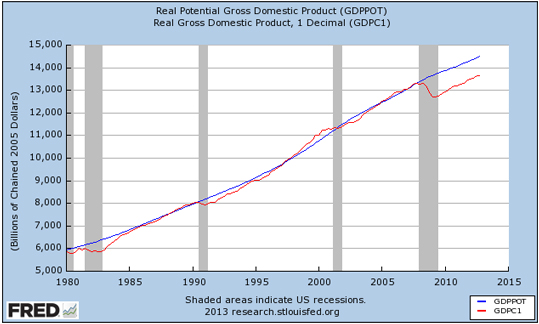

I look at this chart and wonder why our fearless leaders don’t see what’s missing:

Because it’s pretty obvious to me.

The economy is blundering along well below its potential. Every moment that it continues that way we are leaving money on the table. That’s iPods we didn’t buy. Or schools we didn’t build. Or bridges, railways, and roads left in disrepair. Or jobs not created. Or wages not paid. It is even profits not made.

Whichever of these you focus on, and no matter what your political persuasion there has to be something on that list you wanted to see happen, the sad fact is that we have foregone a lot.

More to the point we won’t get it back. That gap between the bottom red line and the top blue line in the chart is the gap between what wealth we created – the red line – and what wealth we could have created – the blue line – had the economy tracked its historic path.

Look back in time on the chart. In each recession – they’re the grey patches – you can see the economy drop below its potential. Subsequently you see the gap close and we return to normal. Once or twice, especially in the latter Clinton years, the economy breaks above its potential and creates wealth at a pace that is not sustainable given our resources and productivity.

It is that yawning gap in recent years we need to look at. The loss is immense. The Congressional Budget Office calculates the loss to have been in the region of $7 trillion. Or at least it will be by the time we finally get back on track, which the CBO suggests is a few years off.

Now think of it this way: $7 trillion is a lot of cash. It would a great big pile were we ever to come across it. It would be unavoidable. We all can think of plenty of things we would like to do with it. So why aren’t we hell bent on finding and getting it back?

Because we can’t agree on how to go about the task.

In my opinion there’s only one sure way to get our money back. We need to stimulate demand. That would shift the red line upwards. But our private industry and households are busy digging out from the crisis. That’s why the red line collapsed. It was a private sector crisis. Businesses fired people. Households saved money instead of buying things. And that withdrawal of spending made business more worried, less profitable, and thus needing to cut more jobs. We fell into a vicious downward spiral where each step was sensible from a personal perspective, but destructive when we added it all up.

The result was that the economy dropped way below its potential. And it got stuck there because of the self-fulfilling nature of the cause.

The only way out was for the government to fill the gap temporarily by spending more. That’s what a stimulus does. It provides spending – and thus keeps that red line up – whilst the private sector gets its house in order.

There are a lot of people who disagree. They argue we need less government spending and more incentive for private businesses to invest and ‘create jobs’.

Think about that in terms of the chart.

Less government spending would move the red line lower. It would make the gap bigger. And more investment would add to potential. It would drive the blue line higher. That would also make the gap larger. Tinkering with the supply side is a fool’s game. It sounds great until you look at what effect it will have. None. In fact it will make matter worse.

No business worth its salt will invest heavily in the face of weak demand. Throwing all the incentives in the world won’t alter that. Think in terms of all the cash sitting on big business balance sheets right now. Profits and cash hoards at near all time highs. Business is wallowing in cash it doesn’t want to spend. Why? Because there’s no one willing to buy more. Wages are flat. Unemployment still lingers way too high. People are still worried about the immediate future.

Right now the only sector of our economy that has both the ability and the opportunity to help fill that gap is the Federal government. It needs to add to its deficit in order to succeed.

Which is why I keep arguing we don’t have a deficit or debt problem. To focus on those is to focus on symptoms not the disease. Our problem is a lack of demand. Crank that up and those symptoms subside of their own accord.

This is not magic. Nor is it a government take over of the economy. It is simply our only way of propping up activity until the private sector gets back on track. The sooner we can close that gap, the better off we will all be.

Or, of course, we can continue to shoot ourselves in the foot. The gap will only get bigger if we keep this up.

In which case that lost $7 trillion may seem like the good old days.