Growth, But Barely?

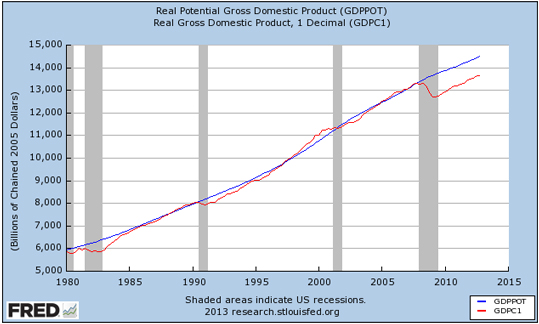

Today’s headline is that the economy grew, just, in the fourth quarter last year. GDP rose at an annual rate of 0.1%, down from 3.1% in the third quarter and at the slowest pace in almost two years.

But things aren’t that bad. On the contrary the report is quite encouraging. this is one of those occasions when we need to dig a little deeper into the numbers.

Here are the basics, broken out by primary economic sector:

- Personal consumption grew at a 2.1% rate; this contributed 1.47% to the total

- Private investment slumped, declining at a -1.5% annual rate; this reduced the total by -0.2%

- Exports and Imports both declined, at annual rates of -3.9% and -4.5% respectively; this added 0.24% to the total

- Government spending declined sharply, at an annual rate of -6.9%; this subtracted 1.38% from the total

Now here’s the good news:

There are some major quirks inside those numbers.

Private investment looks rotten on the surface until we realize that the entire decline can be attributed to a major inventory adjustment. Without inventories investment actually grew at its fastest pace in over year. That big shift in inventories is typical. Businesses periodically realize they have overstocked and try to compensate in the next period. There is nothing particularly abnormal about the swing in the fourth quarter, and it has little bearing on the sustainable rate of growth we have carried forward into 2013.

The other real oddity in the figures is in defense spending which dropped a remarkable -22.0% in the fourth quarter after having jumped up 12.9% in the third. Obviously the data needs to be smoothed out to accommodate such shifts, and even with a tighter budget there is no way that we will see a repeat of the fourth quarter any time soon. Setting aside defense, spending at the federal level rose 1.8% which was mostly offset by a continued decline – of -1.3% – at the state and local level. So without defense total government spending was a nearly neutral factor for the economy late last year.

In terms of looking forward into this year it is encouraging to see personal consumption continuing to contribute a healthy amount to activity. That 2.1% growth rate is vital as we seek to keep the recovery on track. Consumption has grown steadily, but not outrageously, in every quarter for three straight years, the last decline coming in the third quarter of 2009.

Without the quirks I noted above the economy would have grown at a healthy 3.0%, virtually identical to the 3.1% of the third quarter, so it safe to say that the recovery remains on a decent trajectory.

That, however, may end soon as the sequester eats into government spending. My original thought for 2013 growth was in the range of 2.0% to 2.5%. With the upcoming budget cuts that has to be reduced by at least 3/4%, so instead of a decent year in 2013 we will get minimal growth and thus will prolong the rotten employment outlook much further than we ought.

I find it strange that Congress actually is proposing a slower economy, one that might even totter on the edge of recession, but that’s exactly what the House seems to want. The dominant thought in the House is that cutting government spending will magically release a surge of confidence in the private sector and thus more than offset the negative effects of the cuts. It won’t. It never has. It never will. Private sector confidence is a function of a pragmatic assessment of the future. The outlook for demand is the largest single contributor to that assessment. Government tax policy and spending is a much lesser component. So even if businesses and households perk up at the thought of lower future tax bills – which is what right wing theory says happens – that extra optimism will be overwhelmed by the simultaneous realization that demand will ebb as government spending is cut. It is, after all, entirely rational to take into account all the effects of austerity and not just those the right wing prefers us to focus on.

If you disagree take a look at Europe. They tried the austerity-leads-to-growth idea. It has produced nothing but longer deeper recessions, and now is producing a populist backlash. It is an unequivocal failure. But we are about to follow.

That’s just stupid. It’s also where the House wants to go. I haven’t a clue as to why.