More Sideways Than Up

The economy just can’t get on a roll. We managed to get passed the slow down of late last year only to run full square into a self-inflicted slow down this year. Ugh. That’s a technical term for ‘I told you so’. The economy, as measured by Gross Domestic Product (GDP) grew at a 2.5% rate in the first quarter this year. The good news is that the economy gained speed – the last quarter of last year had seen anemic 0.4% growth. The bad news is that this acceleration is too slow to clear up all our excess capacity, especially our severe long term unemployment problem. It is also too slow to get us anywhere near back to our potential. Every day we slop about like this we leave wealth on the table unearned. And that matters to us all. Or at least it ought matter to us all. A lot.

Here’s the breakdown, as usual I show the contributions of each major part of the economy:

- Personal Consumption grew at a 3.2% pace, contributing 2.24% to the total

- Private Investment grew at a 12.3% pace, adding 1.56% to the total – of which 1.03% was in the form of inventory accumulation

- Net exports reduced the total by 0.50% because the growth in exports was more than offset by growth in imports

- Government spending continued to shrink and reduced the total by 0.80%

This is a really mixed bag.

As you can see, the biggest impetus to overall growth came from personal consumption, but no one expects this pace to carry forward much. Disposable incomes dropped 5.3% in the quarter due primarily to the rollback of the payroll tax holiday. Couple this with the continued decline in savings and it becomes very difficult to forecast strong personal consumption for the remainder of the year.

Then there’s the increasing negative effect of the decline in government spending. A large number of people, some in the media as well, seem not to realize that US government spending has been in decline for a while now. Right after the crisis hit, state and local governments around the country began to retrench in order to balance their books in the face of a collapse in revenues. The 2009 Federal stimulus meant that Federal level spending grew for a couple of years, but with that now fully worked through the system, and with the sequester cuts coming on line, even Fed level spending is now declining. Add the two together and total governments spending is acting a strong brake on growth. Which is exactly not what we need to see. But Congress in its wisdom has decided to slash away at the economy. This is despite all the rapidly accumulating evidence that austerity doesn’t, can’t, and won’t work.

Let’s look at two charts:

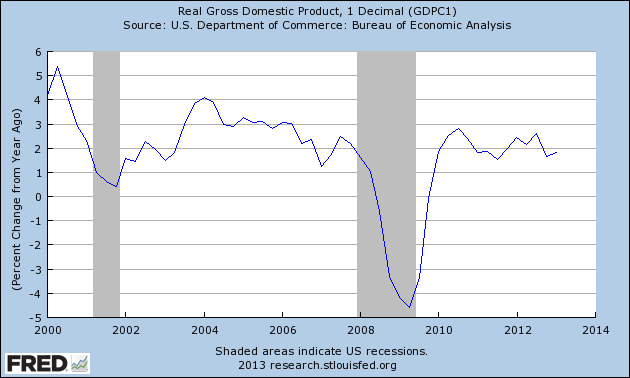

Here’s GDP growth over the last few years …

Yes that dip was enormous.

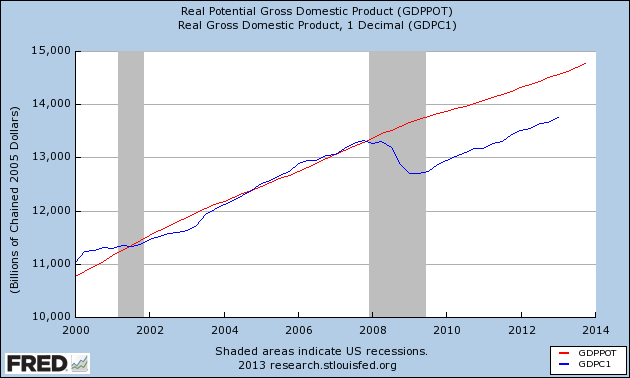

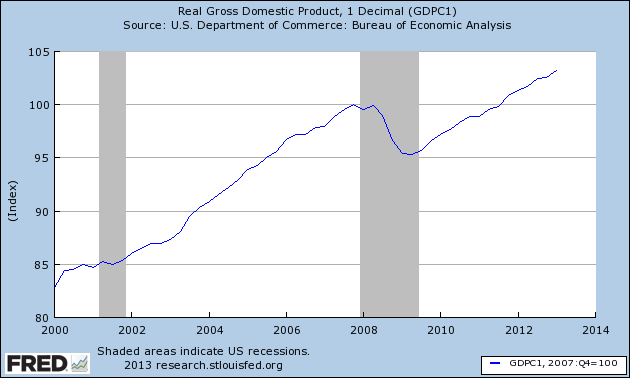

Here’s how the total accumulation looks when we express it as a percentage the peak reached jut before the crisis …

As you can see we’ve managed to get back above the pre-crisis peak. But not by much. That’s because we are running well under a rate of growth enough to get us back to our potential. Here’s the gap between potential and actual …

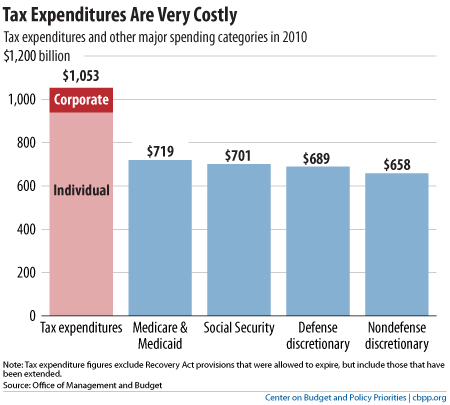

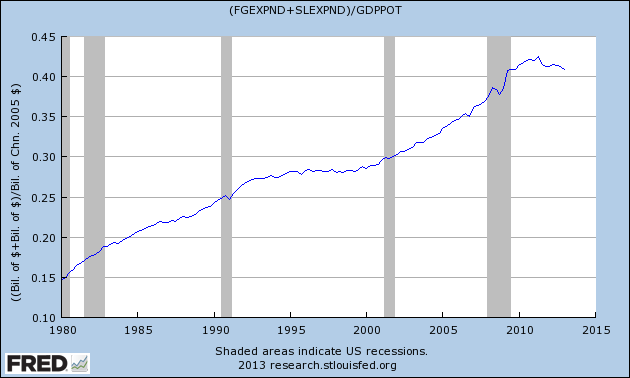

And, last of all, here’s a look at the level of government spending as a percent of that potential GDP …

I think it correct to look at government spending in terms of potential, and not actual, GDP because the result gives us an idea of what that spending looks like were the economy in good shape and not impaired as it is now. Two points ought to leap out at you when you look at the last chart:

I think it correct to look at government spending in terms of potential, and not actual, GDP because the result gives us an idea of what that spending looks like were the economy in good shape and not impaired as it is now. Two points ought to leap out at you when you look at the last chart:

- Both the Reagan and Bush II years show sharper increases in government spending than the intervening Clinton years. Indeed if you look closely you can see that the Clinton era was one of good control over government spending.

- It is very clear that the leap in government spending associated with the crisis has not continued and that the Obama administration is overseeing the only non-recession caused contraction is such spending anywhere on the chart. In fact Obama is pursuing a tighter fiscal policy than any president of the past forty years.

- This Obama austerity movement is not something to applaud. Draining government spending from the economy before the private sector is back to full health makes matters worse, not better.

What does all this mean?

That the economy is not fully healed. That growth is more likely to slow than to accelerate. And that government fiscal policy is working in exactly the wrong direction.

This is not a good message. The first quarter’s 2.5% growth may well be the high water mark for the year. It’s most likely down hill from here.

Unless, of course, Congress decides not to be so stupid. That’s not happening though, is it?