After Bernanke

It is fairly well accepted now that Ben Bernanke will decide not to stay at the Fed next year when his current term is up. By and large I fall into the neutral camp when assessing his tenure. He was woeful at identifying the likelihood of crisis. He has been pretty good at reacting and doing what he can to solve it.

He needs to go back to Princeton and work on upgrading orthodox economic theory in light of its errors, general lunacy, and current irrelevance.

It is very hard to convey the messed up state of economics to outsiders. Economists, after all, speak with such utter conviction and litter their ideas with tons of clever looking math. Most of them know the foundation is rotten and needs replacing, but that is a major upheaval none want to undertake, so they plod along perpetuating the errors while hoping no one notices. Bernanke typifies this part of the profession – self-referential, vaguely aware of its fatal flaws, yet determined not to get out of line lest he appear apostate. To paraphrase an eminent economist of the past: Bernanke is one of those economists who would prefer to be wrong with precision rather than right with a degree of uncertainty.

Anyway, the silly season is upon us as the chatter builds about ‘after-Bernanke’. Who will take his place?

Larry Summers is shamelessly canvassing for support. Summers is one of those people who jumps about, never stays anywhere long enough for us to assess his impact too clearly, is good at networking in the circles of power, and can be relied upon to join whichever team looks like it’s winning. His abiding sin, in my opinion, was his wholehearted advocacy of bank deregulation. It was a catastrophic policy straight from the free market Milton Friedman playbook, and led directly to the crisis. Yet here is Summers running around town trying to be Fed Chairman.

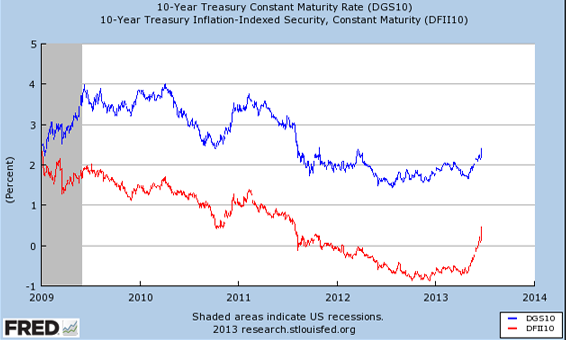

The succession discussion will also give us insight into the way in which our economic elite protects its self interest and ignores the rest of us. Today’s Financial Times offers up a good example of this. Philipp Hildebrand, a BlackRock bigwig, and former head of the Swiss National Bank, writes that the imperative for Bernanke’s successor is to pursue ‘price stability’. This means that fighting inflation is paramount. Of course this is what Hildebrand wants. His constituency consists of bankers and other creditors who fear inflation – they lose money when it rises. So damn the unemployed, and look after the money lenders. This is despite the lack of inflation, and in face of chronically high unemployment. When you read his article you get a great insight into the divergence that bedevils economic policy making. The elite lives in a different world – the current spate of record profits at the big banks is testimony to that – and its issues are not those of the 99%. So, naturally, the policies they advocate are focused on what ails them not us.

Actually, if you read the article carefully you will identify a nod to the 99%. This shows that Hildebrand is aware both of his elitism, and his indifference to the ordinary folk. Here it is:

Therefore Mr Bernanke’s successor must bring to the job rock-solid credentials as someone who will be a central banker committed to price stability. There must be no doubt in the minds of those in company boardrooms, on trading floors and on main street that whatever else happens, the Fed will keep inflation low and stable.

Notice it?

Apparently boardrooms, trading floors, and main street, are all in this together. Not. Main Street tends to be in debt. And debtors benefit from mild inflation – it makes paying debt back cheaper. The banks lose by the same token. So they are not in the same boat. Plus one of the reasons that we’ve had such low and stable inflation over the past three decades is that wages have been squashed. Profits, though, have soared. Boardrooms, trading floors, and main street do not always have the same policy goals. In fact, right now, they are have very different needs.

Bernanke, to his credit, has helped stave off deflation, which would have hammered main street relentlessly, but his successor, according to Hildebrand, needs to plot his or her way (Janet Yelling would get my vote to chair the Fed) away from that and back to old fashioned anti-inflation policy. Even if there isn’t any inflation.

The single minded pursuit of ‘price stability’ is killing Europe, I hope that Bernanke’s successor ignores Hildebrand and doesn’t fall into that same trap. Unemployment matters. Indeed it matters more.

I wonder how many articles the FT will print with that sentiment in mind?