Notes for the Beginning of: What to Do?

This is how I explain what has happened to myself.

Nobody should begin without warning. So we ought jot down some initial observations that provide a starting point for what follows. Some will become highly relevant. Others will fade as we dig deeper into our subject and discover that they were not germane to the main theme. They are in no particular order, since imposing order suggests a level of understanding unjustified by experience. We simply do not know what we do not know and therefore ought make no pretense otherwise. [My economist friends please note!]

Here goes [borrowing along the way from DeLong, Gerstle, and one or two others]:

- The spate of growth experienced in industrialized nations accelerated radically sometime around 1870

- The trajectory of that growth appears vertiginous and is, therefore, unlikely to be maintained. But, we have grown accustomed to it and find it hard to face a future without it. We make the assumption that the present is not an anomaly, but is a new normal

- This rapid growth — usually expressed in the terms economists use, and based entirely upon technological innovation — is the foundation upon which all modernity now rests. Everything we enjoy, better health, longer lives, greater opportunities, broader cultural exposure, and better day-to-day security of existence, in sum our better wellbeing, are all due to the surge in economic growth since 1870. Everything sits on an economic foundation — economics needs a better explanation of why/how this all happened

- This moment in history then, as many have observed, ought to be propelling us towards a future very different from the abject nature of all previous human history — we have broken free [temporarily?] from what has become known as the Malthusian trap and the fabled Utopia ought be within our grasp

- In particular this growth has allowed us to reshape our societies in ways that the constraints of the past disallowed. We have created what we call democracies that include even the least privileged people — albeit haltingly — in the political decision making framework

- It was the degrees of freedom created by rapid economic growth that gave traditional elites — aristocratic, monarchic, religious, military, and landed — both an incentive and the space to share their privileges. Including the masses became both necessary, [as motivation], and wise, [as reward], in order to maintain elite benefits from growth. The alternative, per the period 1789 through 1917, was revolution and destruction of traditional elite power

- Rapid growth also compressed history insofar as change occurred not across generations but within them. Eras that used to be timed in terms of centuries are now timed in decades. Couple this with the existence of multiple generations simultaneously and the traditional cohesion of memory and experience has been overturned. We live with multiple histories and cultures competing for pre-eminence within each society all at once. This complicates politics — inter-generational conflicts muddle class conflicts

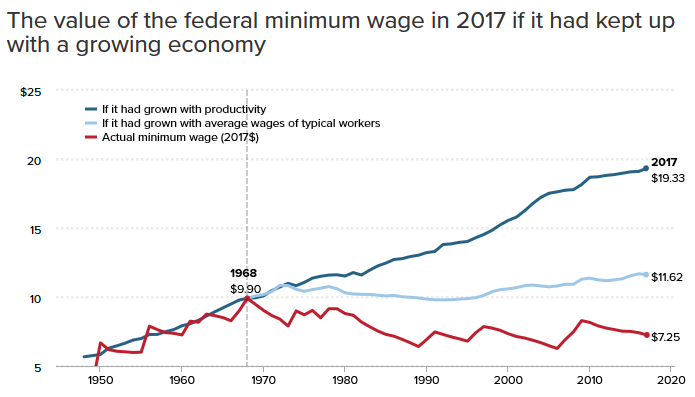

- The political sharing of elite power and the greater speed of change initiated/was initiated by a vastly increased political conflict over the distribution of wealth. Whereas traditional societies had set patterns of distribution based upon time honored social structures, modernity had to invent its own distributional values. The battles to reach a so-called fair distribution has ebbed and flowed largely swept along by shifts in technology and ownership/use of that technology

- Distributional conflict led to a period of intense ideological creativity and argument: Fascism, Communism, and classic liberalism all emerged to compete as frameworks to establish and divide power, wealth, and status. This argument appeared to end sometime in the late 1980s. After which one ideology dominated for a while. Some argued that history had ended, whereas it was only in abeyance

- Because things started to go wrong. The pace of innovation slowed which, in turn, slowed the pace of productivity improvement; the degrees of freedom for elite power sharing were thus reduced; tension mounted; pre-modern social structures began to re-emerge; distribution consequently began to revert to traditional arrangements; ideological conflicts re-arose; politics soured. The re-mergence of radical inequality — both vertical and horizontal [per Elizabeth Anderson] — undermined, if not destroyed, democracy.

- The march towards utopia [per DeLong] — despite our evident historic prosperity — stalled. Why?

- Because we went back in time — society congealed into more noticeable classes once more, only this time the elite was populated not by monarchs, aristocrats, the landed gentry, or military and religious leaders. It was comprised of an upper echelon business class and its technocratic supporters or adherents [including academic economists per Diane Coyle]. This class accumulated a disproportionate share of the national wealth which it used as a resource to entrench itself by capturing government, dominating the framing of public and intellectual discourse, purchasing influence within the media and judiciary, and by upending the institutions meant to maintain balance in society

- The chokehold of this new elite class is the primary cause of our malaise. As this class syphoned off wealth from everyone else — as elites have usually done in the past — it ignored the ongoing structural transformation of the economy. It benefitted from the globalization of capital and so could maintain its own upward trajectory, and, at the same time, overlook the long term consequences of climate change, demographic mix and aging, and the implications of the transition into a service rather than industrial economy

- To these issues our elite has no answers — it has too narrow and self-serving a perspective to create novel responses to potential crises. The intellectual bankruptcy of the ruling class became particularly evident in the lead up to, and in the aftermath of, the Great Recession. Its obvious self-justification and rent-seeking have been on full display ever since. It is a corrupting and negative influence that has to be eliminated if we are to return to our prior path of shared prosperity and relative political harmony. We have collectively sacrificed any meaningful definition of liberty and justice at the altar of shareholder profit. To restore any semblance of democratic dignity we need to rebel. How?