Republican Rot?

This is going to sound parochial to those of you not steeped in America’s current internal conversation.

Poor David Brooks, his column in today’s New York Times is entitled “The G.O.P. Is Rotting”. He is correct. His column is a long lament about his sense of loss. The problem is that the thing[s] he thinks he has lost were largely imaginary. The Republican Party he so longs for was never the party he describes. And the populism he subsequently spits at is not the outright evil he proposes it is.

No: Brook’s problem is that his beloved conservative cause was too easily co-opted by the crassness, corruption, misogyny, and outright narcissism of Trump. All the supposed excellence he lists in his article was no defense against the marauding plebeian horde currently trampling those conservative values into the dust.

Perhaps Brooks ought to ask why it was that the uneducated masses so easily stormed the conservative heights.

Let me help explain:

Brooks anchors his lament firmly on post-Reagan ground. He thus conveniently ignores the venality and overt racism of the Nixon Southern strategy which was designed to shake Southern voters who opposed the civil rights movement of the 1960’s free from their lifelong adherence to the old Democratic party and scoop them safely into the Republican embrace. This is hardly excellence. Nor does Brooks note that Reagan launched his campaign for the presidency in true Nixonian fashion by heading to the same Southern states that Nixon had pandered to. Racism sits squarely at the heart of the modern GOP. It is inescapable. It is rotten populism writ large, but apparently not part of Brook’s preferred trope. So it banished from his memory.

Here’s where he gets going:

“The Republican Party I grew up with admired excellence. It admired intellectual excellence (Milton Friedman, William F. Buckley), moral excellence (John Paul II, Natan Sharansky) and excellent leaders (James Baker, Jeane Kirkpatrick). Populism abandoned all that — and had to by its very nature. Excellence is hierarchical. Excellence requires work, time, experience and talent. Populism doesn’t believe in hierarchy. Populism doesn’t demand the effort required to understand the best that has been thought and said. Populism celebrates the quick slogan, the impulsive slash, the easy ignorant assertion. Populism is blind to mastery and embraces mediocrity.”

If he were to compose a defense of patriarchy or of elitist arrogance he could hardly have chosen better words. Damn the ignorant masses he is telling us, what do they know? They are shallow, lazy, stupid, selfish, and have too short an attention span to undertake the great works of office. The Republican Party he suggests was populated by wise elders who knew how to run things in the interests of the nation as whole and not simply in the interest of the plebes.

The trouble, I would gently suggest to Brooks, is that those self-same wise elders screwed things up royally. Well, they certainly screwed things up for the vast majority of folks many of whom are not ignorant, lazy, shallow and so on. Not at all: indeed many of those whom the wise elders have royally screwed are intelligent and motivated enough to call and end to the games played by the elders.

And that end is called populism.

Now I would never defend Trump’s populism, largely because I think he is a lying, conniving, and incompetent fool. He isn’t motivated to solve the problems of the masses. He is motivated by the acquisition of power and the accompanying grandiosity. He is besotted with himself and nothing, or no one, else. And he is a perfect representation of the modern, rotten, GOP. He has no belief beyond money. He has no worldview beyond what fits on a napkin after a good New York City steak dinner eaten in the company of his cadre of misogynist hangers-on. He has a tenuous grasp of the complexity of economic policy. He has no interest in, or empathy with, the people whose emotions he stirred up; and no interest in solving any major problems. His entire approach is one that assumes anything that predates his ascension to the throne needs to be broken by virtue of predating him. There is no philosophy of governance.

And that’s Brook’s issue.

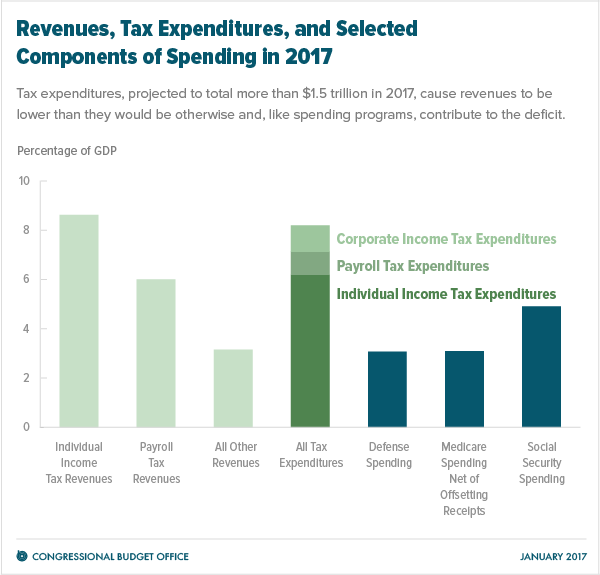

The modern Republican Party has no philosophy of governance either. It is simply the tool of the plutocratic elite. It does the bidding of the few even when that bidding causes it to contradict its heritage. So the GOP attacks deficits when those deficits might have a social purpose and defends them when they are produced by tax cuts for the rich. It has no theory about the efficacy of deficits. All that matters is channeling the benefits of growth into the hands of its benefactors.

Then there’s this:

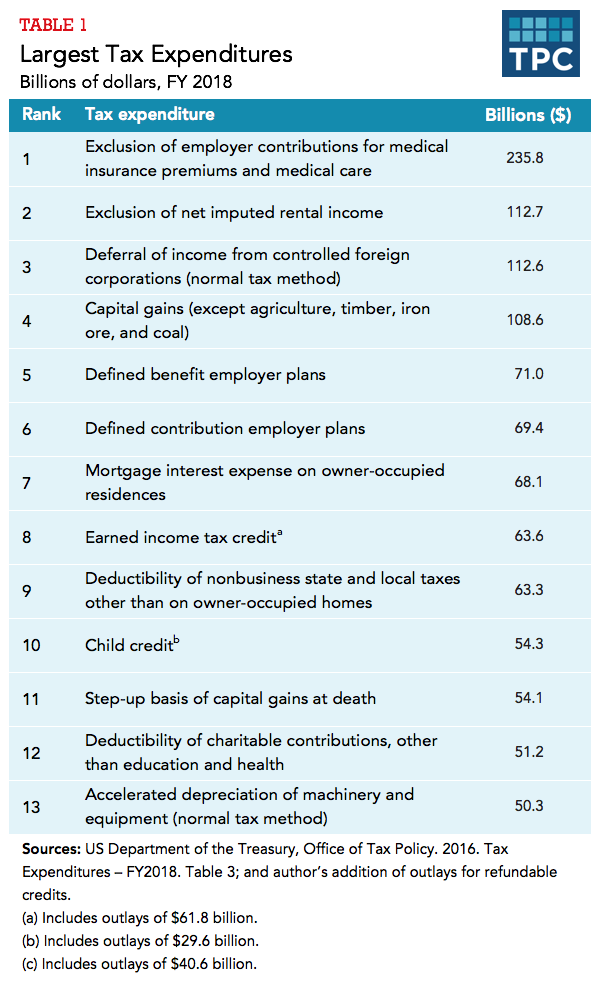

“Compare the tax cuts of the supply-side era with the tax cuts of today. There were three big cuts in the earlier era: the 1978 capital gains tax cut, the Kemp-Roth tax cut of 1981, and the 1986 tax reform. They were passed with bipartisan support, after a lengthy legislative process. All of them responded to the dominant problem of the moment, which was the stagflation and economic sclerosis. All rested on a body of serious intellectual work.

Liberals now associate supply-side economics with the Laffer Curve, but that was peripheral. Supply-side was based on Say’s Law, that supply creates its own demand. It was based on the idea that if you rearrange incentives for small entrepreneurs you are more likely to get start-ups and more innovation. Those cuts were embraced by Nobel Prize winners and represented an entire social vision, favoring the dispersed entrepreneurs over the concentrated corporate fat cats.”

There’s a couple of choice pieces in there. Stagflation I will concede. Sclerosis I will not. GDP grew about 3.2% in the Carter years and about 3.5% in the Reagan years. That small increase came at the cost of a massive sea of red ink — never before experienced without crisis as a cause — and the headlong rush into inequality and insecurity that characterizes the long arc of the post-Reagan era through to today. I would argue that the cost was too high. Brooks would too if he could get himself to understand that contemporary populism is rooted in that inequality and insecurity rather than being an expression of lowlife ignorance.

Then there’s the reference to the intellectual framework offered by Say’s Law: “Supply will create its own demand”. Really? So, after several massive tax cuts (Brooks mentions only three, he ignores GW Bush) each designed to shovel money into the maw of the capitalist class and thus, presumably to set in motion that great creation of demand, why is it that we suffer from a chronic and crippling lack of demand? Say’s Law is habitually trotted out by the ideologically committed right as cover for the distribution of wealth upwards. An excellent case can be made that it is thoroughly disproven by history and ought to be consigned to the rubbish heap. Keynes long ago said as much. But the right has not much else to offer. So it keeps repeating that same mistake over and over again.

Except, of course, it is not a mistake. It is the consequence of the rot within the modern GOP. The intellectual virtues that Brooks parades before us have been shown to be errors by history. The Republican project he so lauds is a failure. It needs replacing and modernizing. The current ramshackle legislation called “tax reform” is an example par excellence.

To paraphrase Brook’s hero Ronald Reagan: “There they go again”.

Yes, David, the GOP is rotten. But it was back in the era you imagine as its finest hour. This isn’t news.